Get the free 11 c form

Show details

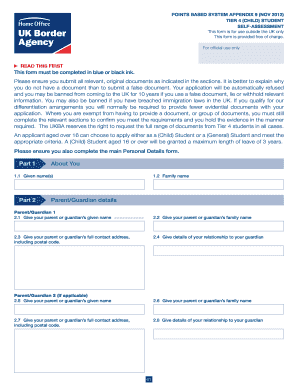

Form 11-C Occupational Tax and Registration Return for Wagering Rev. January 2001 OMB No. 1545-0236 Return for period from Department of the Treasury Internal Revenue Service to June 30 Month and day Year Name Use IRS label. Otherwise type or print. Employer identification number Number street and room or suite no.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 11 c form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 11 c form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 11 c online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 11c. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

How to fill out 11 c form

How to fill out Form 11 C:

01

Start by gathering all the necessary information and documents required for Form 11 C, such as your personal details, employer details, and any relevant financial information.

02

Carefully read the instructions provided with the form to ensure you understand each section and the information required.

03

Begin by filling out the top portion of the form, providing your name, address, and Social Security number or Employer Identification Number (EIN), depending on whether you are an individual or an employer.

04

Proceed to section A of the form, where you will need to provide details about your current tax return-related contact information. This includes your mailing address, phone number, and email address.

05

In section B, provide details of the specific tax return(s) you are seeking relief from the electronic filing requirement for. This may include tax periods, tax form types, and reasons for seeking relief.

06

If you are an employer seeking relief from electronic filing due to undue economic hardship, complete section C. Provide details regarding your business, financial condition, and any supporting documentation required.

07

Ensure that you have signed and dated the form in the appropriate section.

08

Review your completed form for accuracy and completeness before submitting it.

Who needs Form 11 C:

01

Individuals who are unable to file their tax returns electronically and wish to request relief from the electronic filing requirement.

02

Employers who are unable to electronically file the required employment tax returns due to undue economic hardship.

Please note that this is a general overview, and it is always recommended to consult the specific instructions and guidelines provided with Form 11 C or seek professional advice for accurate and personalized assistance.

Fill form : Try Risk Free

People Also Ask about 11 c

Does occupation matter on tax return?

What is Form 11 C?

Can I get in trouble if my tax preparer made a mistake?

What do I put as my occupation taxes?

What happens if you put the wrong occupation on your taxes?

What is the federal wagering excise tax?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 11 c?

Form 11-C is a form used by employers to report and pay the Occupational Tax owed on wages paid to their employees. This form is used to collect the tax established by the Internal Revenue Code (IRC) and is filed with the IRS. It is also used to report the tax that is due to the Social Security Administration.

Who is required to file form 11 c?

Form 11-C is a form that is required to be filed by employers and certain other persons who pay reportable gambling winnings. The form is used to report the amount of federal income tax that was withheld from gambling winnings.

How to fill out form 11 c?

Form 11-C is a federal form used by employers to report their annual wage and tax withholding information to the Internal Revenue Service (IRS).

Step 1: Fill in the Employer information. Fill in the name and address of the employer, the Employer Identification Number (EIN), and the type of organization.

Step 2: Fill in the Calendar Year Information. Enter the year that the form applies to.

Step 3: Fill in the Social Security Number (SSN) Information. Enter the SSNs of all employees who have received wages during the calendar year.

Step 4: Fill in the Total Wages Paid. Enter the total wages paid for the year, including all wages, bonuses, and other forms of pay.

Step 5: Fill in the Withholding Information. Enter the amounts withheld for federal income tax, Social Security tax, and Medicare tax.

Step 6: Fill in the Signature and Date. Enter the signature and date of the person who is completing the form.

When is the deadline to file form 11 c in 2023?

The deadline to file Form 11-C in 2023 is March 31, 2023.

What is the penalty for the late filing of form 11 c?

The penalty for the late filing of Form 11-C is a minimum of $25 per month up to a maximum of $100 per month, not to exceed 25% of the total tax due.

What is the purpose of form 11 c?

Form 11-C is used to report the tax liability on wagers accepted by a person engaged in the business of accepting wagers. This form is filled out by individuals or businesses who have a gambling enterprise, such as a bookmaker or lottery or sweepstakes operator. The purpose of Form 11-C is to report and pay the tax on wagers received and to maintain records of wagers for tax purposes as required by the Internal Revenue Service (IRS).

What information must be reported on form 11 c?

Form 11 C is the Occupational Safety and Health Administration's (OSHA) "Employer's Annual Certication of Hazardous Employment of Minors." It must be completed and submitted by employers to certify that they are complying with all applicable child labor laws and are providing a safe working environment for minors. The information that must be reported on Form 11 C includes:

1. Employer's name, address, and phone number

2. Name of the person responsible for completing the form

3. The date the report is being completed

4. The name, title, and phone number of the person to contact with questions about the report

5. Physical location(s) of the workplace(s) where minors are employed

6. The number of minors (under 18 years old) employed by the employer during the calendar year and the maximum number of minors employed at any one time during the year

7. The number of minors performing hazardous occupations or tasks and a detailed description of the hazardous occupations or tasks

8. A statement indicating whether the employer has secured and maintained on file appropriate proof of age for each minor employed

9. Any changes to the previously reported information, if applicable

Employers must sign and date the form to certify its accuracy and compliance with child labor laws.

How do I edit 11 c straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing form 11c.

How do I edit form 11c pdf on an iOS device?

Create, edit, and share 11 c form from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I complete form11c on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your form 11 c. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your 11 c form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 11c Pdf is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.